Do you know some place where we could put our return envelopes

for supporters to mail back donations?

Tell us where and we'll deliver them.

Donations online are no longer being processed.

|

|

|

By Harry Welty According to the information coming out of JCI and the If you multiply $11 dollars, by 12 months and then multiply

that by 20 years you get $2,240 per household. If you assume that there are 2.5

people per household this would result in $896 in taxes for the average resident

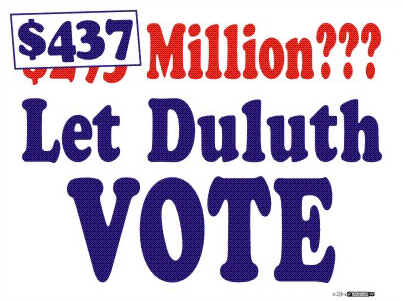

of the But if you multiply this average individual tax burden by the 94,000 residents of the Duluth School District the resultant taxes over twenty years would yield only $84,224,000 a far cry from the $437 million it will take to finance the Red Plan.. If you simply divide the $437,000,000 figure by the Districtís 94,000 residents you come up with a considerably higher per person tax over twenty years - $4,649. As some wag once said, ďfigures never lie, liarís figure.Ē JCI has had a long history of working with school districts

on issues relating to air quality and construction. It advertises itself to

school districts as an expert in helping pass bond referenda. It must be very

annoying for JCI to put in lots of work with a District only to see a referendum

voted down. In fact, half of the There have certainly been many changes to state laws over

the years which permit small projects to be approved by the state rather than by

local voters. The question would be whether there have been enough changes to

justify letting a district other than Last spring JCI paid for a survey of It was so important that shortly after the survey was taken

it was announced that 71% of the people in It was so important that JCI placed the results from

Question 26 into its report for review and comment no less than four times.

Itís on the front page. Itís on an impressive graph on the next to last

page. Itís on pages 40 and 75. It tells the State Ed Dept. that How has JCI managed to make a $293 million building plan look so financially modest. At the first meeting of Let Duluth Vote one of the 34

citizens on the select committee came to our meeting and explained that the cost

of the Red Plan would only be $100 million dollars of bonding. We were confused

by this figure, at first until it occurred to us that while the cost of bonding

might only be $100 million the Red Plan would impose additional taxes for its

lease levy purchasing. While JCI may not have been responsible for this bit of

misinformation it dissemination didnít speak well of the select committee that

one of its members had such a poor grasp of the costs For its part, JCI itself was just as bad. For one thing the

$9 to $11 dollar figure JCI used was based on a promise that it or the school

board could not keep. JCI said that as long as some of the Red Plan costs were

funneled into property tax relief the taxes would remain at this level. However,

if the property taxes were not plowed into property tax relief the taxes would

nearly double. This will almost certainly be the outcome in In part itís because voters are being denied a right to

vote and will want to take their anger out on the School Board. Next year, after

they open their property tax statements, they will almost certainly vote against

an excess levy for operational expenses. This is all the more likely because the

current school board plans to double the existing excess levy. In the face of

this reality, future school boards are almost certain to make up for the loss of

Thereís more. JCI has explained that it has based the

average tax costs on the ďmedianĒ priced home in the And thereís this. (Page 79 of the Red Plan report for Comment and Review) To advertise the lowest possible tax for the Red Plan JCI back ended the taxes for the Red Plan. Next yearís Red Plan taxes will only be about one-third as much as they will be in its final year. The taxes increase at roughly 5.5 % per annum. JCI has made a very compelling case for the Red Plan. They

just havenít made a very honest case. Even so they may have found enough

loopholes to shove the Red Plan down the throats of Duluth Voters. The people of

|

|